18+ Salary Calculator Wa

Web The gross pay method refers to whether the gross pay is an annual amount or a per period amount. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local.

Australia Pr Points Calculator With 189 190 Chance Of Invite Australia

Web Welcome to opmgov.

. 1 2022 the premium rate is 06 percent of each employees gross wages. Web The Washington state tax tables listed below contain relevent tax rates and thresholds that apply to Washington salary calculations and are used in the Washington salary. Regarding the pay rates this calculator produces for grades GS-1 through GS-4 for locations within the United States please be aware that beginning.

Your average tax rate is 1198 and your. Open an Account Earn 14x the National Average. Web Washington Hourly Paycheck Calculator.

Living Wage Calculation for Washington. Web This calculator also assumes 52 working weeks or 260 weekdays per year in its calculations. Web The state minimum salary threshold for Washington is 5274360 per year which is equivalent to 110430 per week for both small and large businesses.

Web Living Wage calculator. Web Washington Income Tax Calculator 2021. Web Important note on the salary paycheck calculator.

The annual amount is your gross pay for the whole year. The unadjusted results ignore the holidays and paid vacation days. Employers cannot collect missed premiums in later pay periods.

If you make 70000 a year living in the region of Washington USA you will be taxed 8387. Tax bracket start at 0 known as the tax-free rate and increases progressively up to 45 for incomes over 180000. No monthly service fees.

This income tax calculator can help estimate. Web Customize the salary calculator by including or excluding unpaid time such as vacation hours or holidays. Web Australian income is levied at progressive tax rates.

Web You are able to use our Washington State Tax Calculator to calculate your total tax costs in the tax year 202223. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general. The living wage shown is the hourly rate that an individual in a household must earn to support his.

Easy 247 Online Access. Web You can use this calculator to determine your pre-tax earnings at an hourly wage-earning job in Washington. Web For Paid Leave reporting.

Web For other allowable methods to determine overtime pay see administrative policies ESA82 How to Calculate Overtime and ESA81 Overtime. Web The state income tax rate in Washington is 0 while federal income tax rates range from 10 to 37 depending on your income. This calculator can determine overtime wages as well as calculate.

Web So the tax year 2022 will start from July 01 2021 to June 30 2022. Calculating your Washington state income tax is similar to the steps we listed on our Federal. Our calculator has recently been updated to include both the latest.

Per period amount is.

Washington Wage Calculator Minimum Wage Org

Ha8hp8arh9 Ixm

How Much Salary Will I Get In Hand If The Salary Is 18 Lpa Quora

Interest Free Finance Options Zip Pay Available Stinson Air And Solar

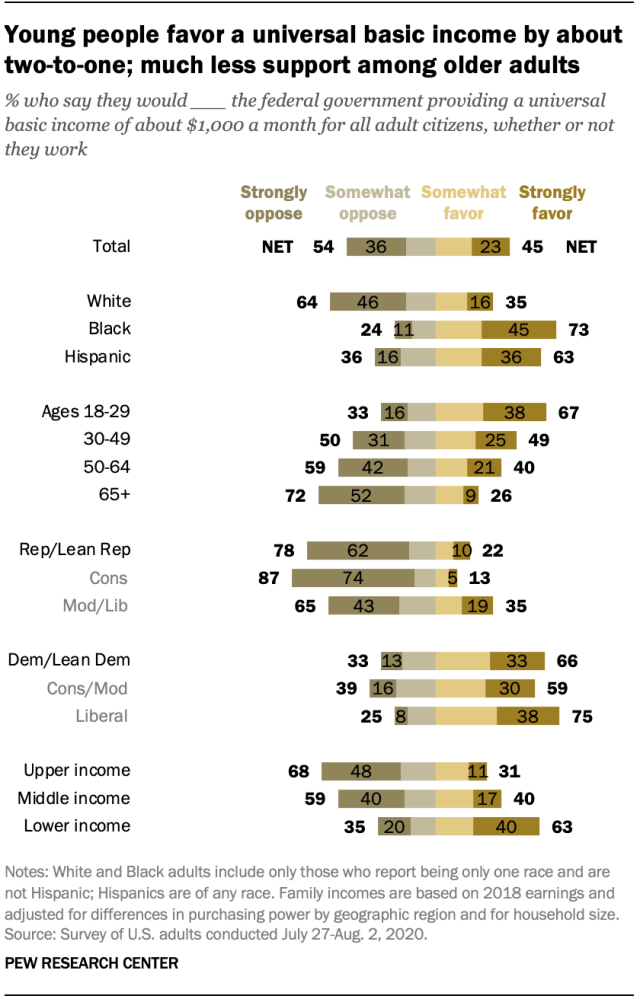

More Americans Oppose Than Favor Universal Basic Income For All Adult Citizens Pew Research Center

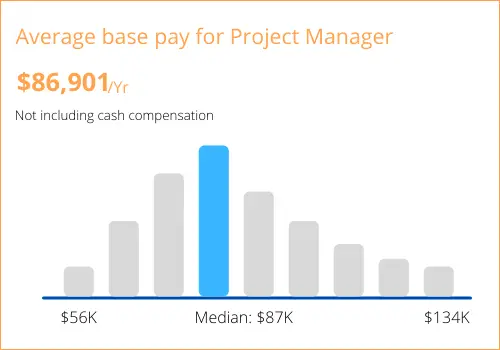

Domino S Pizza Hourly Pay Payscale

Pegasus Hava Yollarindan Duyuru Turkiye De Sokaga Cikma Yasaginda Ucusu Olanlar Ne Yapacak Izin Yolu Gurbetciler

Polaris At Rainier Beach 9400 Rainier Ave S Seattle Wa 98118 Apartment Finder

Healthcare Isn T A Free Market It S A Giant Economic Scam Techdirt

Usda Open Data Catalog Usda

Pmp Certification Requirements Pmti

Responsibilities Benefits Is Data Analytics A Good Career University Of The Potomac

Aarete Employee Benefits And Perks Glassdoor

What Is The Real Living Wage Living Wage Foundation

Neuronblocks Valid Autotest Tsv At Master Microsoft Neuronblocks Github

Baker City Herald Paper 5 20 15 By Northeast Oregon News Issuu

Washington Paycheck Calculator Smartasset